The history of taxation, evolution of tax planning, when did tax day change, tax day observed by, the times making tax digital, history of tax day, beginning of the tax year, tax day this year, when was tax day, the evolution of tanks, the evolution, the evolution of humans,

Taxes are an integral part of every country's economy. They are considered the lifeblood that helps the government raise funds to provide necessary services such as healthcare, education, and infrastructure development. Over the years, taxes have undergone various changes, and the way they are collected and monitored has also evolved. In this post, we take a look at the evolution of taxes and how technology has impacted the way we pay taxes.

Evolution of Tax Freedom Day

.gif)

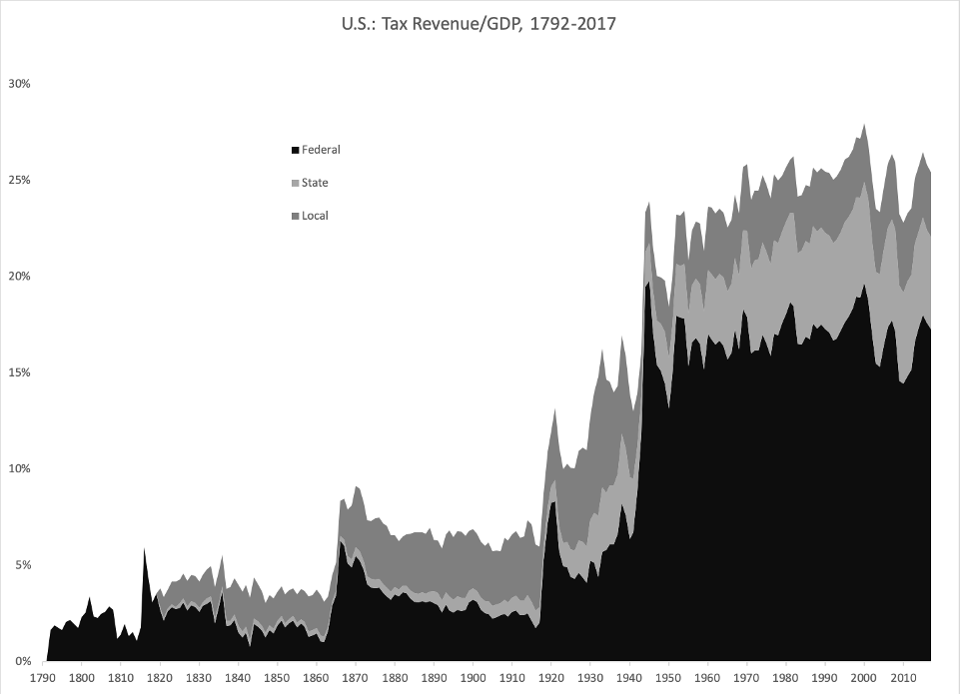

The concept of Tax Freedom Day was first introduced in the 1940s by the Tax Foundation, a non-profit organization based in Washington D.C. It is the day of the year when the average American has earned enough to pay their federal, state, and local taxes for the year. The infographic above shows the Evolution of Tax Freedom Day from 2007 to 2008. As you can see, Tax Freedom Day has been moving later in the year, which means that Americans are paying more taxes.

The Evolution Of Tax Technology

The way taxes are collected and monitored has undergone significant changes over the years. With the advancements in technology, the process of filing taxes has become more convenient and efficient. The above infographic shows the Evolution of Tax Technology, from the manual process of filling out paper forms to the current online filing system. With the introduction of e-filing, taxpayers can now file their taxes from the comfort of their homes, reducing the need for physical visits to tax offices. The use of automation tools has also made the process of tax collection and auditing more accurate and fast.

How The Tax Cuts and Jobs Act Evolved

The Tax Cuts and Jobs Act (TCJA) is a tax reform bill that was signed into law in December 2017. The above infographic shows the Evolution of the TCJA, from its introduction as a proposal to its implementation. The TCJA aimed to simplify the tax code and provide tax relief to individuals and businesses. With the introduction of new tax brackets, increased standard deductions, and tweaks to deductions and exemptions, taxpayers saw changes in their tax bills. The TCJA also impacted businesses, with reduced corporate tax rates and the introduction of new tax deductions.

Evolution of Service Tax in India

Taxes in India have also undergone significant changes over the years. The above infographic shows the Evolution of Service Tax in India, from its introduction in 1994 to its current state. Service Tax is a tax levied by the government on all services, excluding a few specified services. Over the years, the scope of Service Tax has been expanded, and the tax rate has increased, impacting both service providers and consumers. The introduction of the Goods and Services Tax (GST) in 2017 replaced Service Tax and other indirect taxes, providing a more unified tax structure for businesses and consumers.

IRS Drops Longstanding Promise Not to Compete Against TurboTax

The above image shows how technology has impacted the relationship between the Internal Revenue Service (IRS) and tax preparation software services such as TurboTax. In January 2020, the IRS dropped its longstanding promise not to compete against tax preparation software services. As a result, the IRS launched its own Free File Program, which allows eligible taxpayers to prepare and file their federal tax returns for free. This move has been both praised and criticized by taxpayers, with some welcoming the competition and others concerned about potential conflicts of interest.

In conclusion, taxes have always been an essential part of any country's economy, and their evolution has impacted individuals and businesses alike. With advancements in technology, the process of tax collection and payment has become more efficient and convenient for taxpayers. However, it is essential to keep in mind that taxes are crucial for the functioning of society and ensure that the necessary funds are available for the provision of essential services.

The Evolution of Tax Day: From Paper Forms to Online Filing

If you are looking for The evolution of tax technology new world economics, you've came to the right place. We have images like Irs drops longstanding promise not to compete against turbotax ars, evolution of tax system in india blog by quicko, día del contribuyente. Here you go:

Paper calculations 20% of americans are making this tax filing mistake, the evolution of tax a fiftyyear perspective by rsm global issuu

Evolution of service tax in india. Tax irs refund filing getty received turbotax deductions if representation taxes year contact haven deficiency notice agent estate every should. Evolution tax india system quicko 1974. Evolution tax india system quicko come ve way long. Evolution of tax system in india blog by quicko. Paper calculations 20% of americans are making this tax filing mistake. Closing the gap between formal and material health care coverage in

Also read:

.Blog Archive

-

▼

2023

(280)

-

▼

April

(86)

- Countdown To Mlb Opening Day 2023

- Alvin Bragg Family Photos

- The Evolution Of Tax Day: From Paper Forms To Onli...

- What Is Vivo Investigation

- Father Damien And Interfaith Relations: His Respec...

- Mlb Opening Day 2023 Pick Em

- When Is Mlb Opening Day For 2023

- Alvin Bragg Petersburg Va

- Opening Day Mlb Odds

- Mlb Baseball Opening Day 2023

- Mlb Opening Day Lineups 2023

- What Is Investigation Methodology

- What Is Conviction History

- 2023 Mlb Opening Day Lineups

- Mlb Opening Day 2023 Yankees

- Celebrating Good Friday: Ideas For Honoring The Ho...

- Mlb Opening Day No Hitter

- Alvin Bragg For Da

- Alvin Bragg Early Life

- Da Alvin Bragg Jose Alba

- Outdoor Shooting Range Nashville Tn

- Alvin Bragg Jose Alba

- What Is Investigation Research

- What Is Jpc Investigation

- Mlb Opening Day 2023 Nyy

- Shooting East Nashville Today

- Holy Saturday Around The World: How Different Cult...

- Mlb Opening Day Cardinals

- Shooting On West End Nashville

- What Is Investigation Teaching Method

- Opening Day Mlb Gif

- Holy Saturday Reflections: Contemplations On Chris...

- Nashville Smile Direct Club Shooting

- The Music Of Orthodox Good Friday: From Byzantine ...

- Nashville Tn Skeet Shooting

- Alvin Bragg Early Life

- What Happened To Stormy Daniels Lawyer

- What Is Conviction Ethics

- Alvin Bragg Appointed By

- Nashville Police Shooting Woman

- Shooting East Nashville Tn

- What Is Investigation Type

- Nashville Police Shooting I65

- Mlb Opening Day Lineups 2023

- What Is Conviction From God

- What Is Legal Investigation

- Mlb Cubs Opening Day

- Day And The Legacy Of Abraham Lincoln: Examining H...

- Alvin Bragg Ny Times

- What Is An Indictment Mean

- Alvin Bragg Da Manhattan

- Mlb Opening Day 2023 Scores

- Holy Saturday And The Paschal Mystery: Understandi...

- Alvin Bragg Da New York

- Mlb Opening Day Yankees

- What Is Quantitative Investigation

- Emancipation Day: Remembering The End Of Slavery I...

- Mlb Opening Day 2023 April 7

- Easter Sunday In A Secular World: How Non-Christia...

- Nashville Cop Shooting Today

- Mlb Opening Day World Series Odds

- What Is Conviction Judgement

- What Is Direct Indictment In Virginia

- Mlb Network Opening Day Schedule

- Nashville Outdoor Shooting Range

- Mlb Opening Day 2023 Logo

- Shooting On Charlotte Pike Nashville Tn

- What Is Investigation Report In Hospital

- Mlb Opening Day 2023 Tickets

- Cop Shooting In Nashville

- Patriots' Day Celebrations: From Reenactments To P...

- Shooting Range Downtown Nashville

- What Is Verdict Conviction

- Nashville Skeet Shooting Range

- Mlb Opening Day 2023 Red Sox

- Trap Shooting Range Nashville

- Mlb Opening Day 2023 Box Scores

- What Is Indictment With Trn

- What Is Conviction Chicken

- Mlb Opening Day 2023 Mariners

- Alvin Bragg Mailing Address

- What Is Jpc Investigation

- Shooting Range Downtown Nashville

- Mlb Opening Day Pirates

- Stones River Shooting Range Nashville Tn

- Nashville Shooting At Funeral

-

▼

April

(86)

Total Pageviews

Search This Blog

Popular Posts

-

Vrbo south haven michigan beachfront homes, south haven michigan beach camera, vacation rentals south haven michigan, city of south haven mi...

-

Soalan matematik tahun 6 dangerous covid 19 soalan matematik tahun 6 dancers soalan matematik tahun 6 danielson soalan matematik tahun 6 iku...

-

Alvin bragg lee zeldin attacked, alvin bragg lee zeldin shooting, alvin bragg lee zeldin polls, alvin bragg lee zeldin family, alvin bragg l...